The Current State of Denver Real Estate - January 15, 2024

Happy New Year buyers! The good news for buyers is that interest rates have dropped and stabilized around 6.5% for Conventional loans and around 6.0% for VA and FHA. Of course, it still depends on the amount of money being put down and your credit scores, but the rates have improved since the third quarter of last year for all borrowers. It is anticipated that rates may possibly drop a little more this year, but the question is when? Many sellers are still advertising rate buy downs or other seller concessions to help with buyer’s closing costs, which can help even more with rates and loan costs.

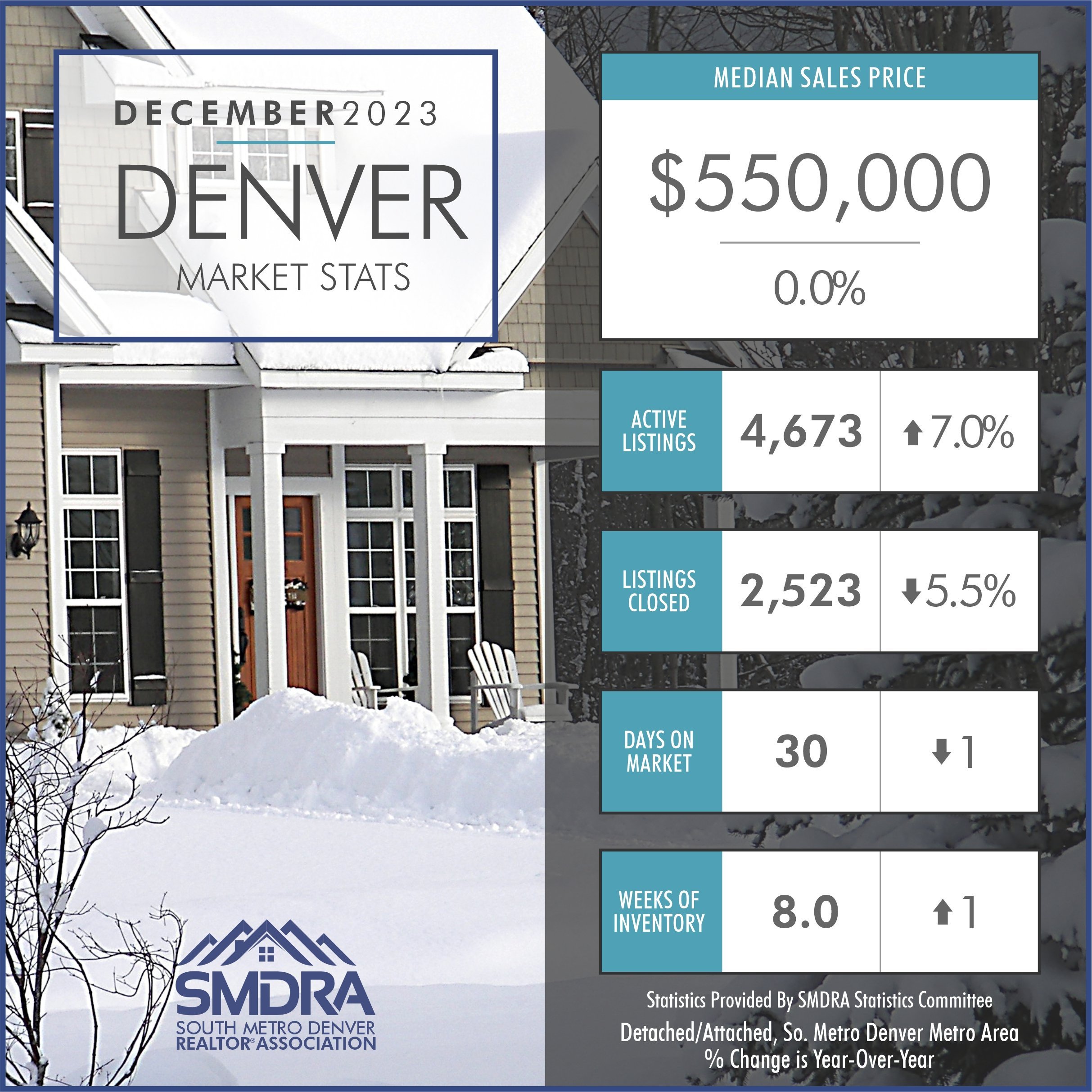

Although prices fluctuated throughout 2023, in the end the median price was the same in December of 2022 as it was in December of 2023. The market did seem to pick up near the end of the year, especially in the higher price point of $1,000,000 and up. Per usual, anything under $400,000 was also quick to go under contract.

Many HOA’s increased their monthly fees at the beginning of the year to cover the massive increase in homeowner’s insurance and other increases throughout the year. Many complexes had their insurance rates double, and that is if they were even lucky enough to find insurance if their policies weren’t renewed. It is further anticipated that property taxes will go up a minimum of 25% this year as well. Obviously all of those costs are eventually going to be passed on to the homeowners or tenants, increasing monthly payments by $400-$600 in some cases (PITI) or in rents. Prices in Colorado simply continue to soar!

One option investors may consider is to purchase an investment property through your Self-Directed IRA. It’s a great way to buy property, save on taxes, hedge on inflation and not risk having your money in the stock market. If you have any questions about that, feel free to contact any of us at The Tucker Team. We’d be happy to provide you with additional information as to the benefits of buying a rental home through your IRA.